In 1956, Henry Ford II faced a pivotal decision. The Ford Motor Company, his grandfather’s legacy, needed to go public – a move that would fundamentally restructure the family’s ownership of their empire. Through careful planning and strategic restructuring (and a little help from Goldman Sachs)1, the Ford family maintained control while creating one of history’s most successful public offerings. Today, nearly 70 years later, the Ford family still maintains significant voting power2 through their carefully structured share classes.

This matters more now than ever. According to recent estimates, about $84 trillion in assets will transfer3 between generations over the next two decades.

Business owners who take thoughtful action today can help ensure their share of that wealth successfully reaches the next generation rather than getting eroded by unnecessary taxes or family disputes.

Key Strategies for Restructuring (and How They Work)

Not all restructurings are alike. Here are a few common strategies – each essentially a tool that can be used to solve different problems or goals:

Entity Type Changes

The legal form of your business (C-Corp, S-Corp, LLC, partnership, etc.) has big implications for taxes and flexibility. As your goals evolve, it may make sense to convert from one type to another. For instance, many family businesses start as an LLC or S-Corp for pass-through tax benefits. But if you’re eyeing major growth or bringing in investors, converting to a C-Corp could facilitate that (even though C-Corps have their own tax regime).

Conversely, if you currently operate as a C-Corp but plan to keep the business in the family, you might evaluate an S-Corp election to avoid double taxation on dividends. Each entity type has pros and cons – restructuring can involve reclassifying your company to the type that best suits your next chapter. Always check the tax consequences before switching–there can be tax consequences to convert, but long-term savings might outweigh them.

Let’s look at an example: Consider Sarah, who built a successful manufacturing business as an LLC. Her company now generates $5M in annual revenue, and she’s starting to think about retirement and passing the business to her children in the next decade. Currently, all profits flow through to her personal tax return – which made sense when starting out, but now creates a significant personal tax burden and complicates her retirement planning.

Let’s look at a different scenario: Michael founded a promising software company as an LLC five years ago. His business has grown to $5M in annual revenue, and he’s eyeing significant growth opportunities. While the LLC structure served him well initially, it’s now limiting his ability to maximize long-term wealth preservation, especially given his exit timeline.

By converting to a C-Corporation now, Michael positions himself to potentially save millions in taxes when she eventually sells. Here’s why: Section 1202 of the tax code offers a powerful but often overlooked benefit – qualified small business stock (QSBS) treatment. If she holds the stock for five years after conversion and meets other requirements, she could exclude up to $10 million in capital gains from the eventual sale.

With QSBS: Up to $10M in gains potentially excluded

If his company sells for $30 million in five years, that’s a potential tax savings of over $2 million compared to selling as an LLC. Yes, he’ll pay corporate taxes in the meantime, but the exit tax savings could dwarf those annual costs.

Ownership Structure Shifts

Sometimes, the way ownership is divided needs to change to meet your planning goals. This could mean gradually transferring shares of the business to your children or a trust, so that they assume ownership over time without a sudden, heavy tax event. It might also involve recapitalizing your company’s stock into different classes (voting vs. non-voting shares) as part of an estate freeze or succession plan.

The aim here is to smooth the succession process – you maintain control while you’re active, but you’ve set the stage for a seamless transition when you’re ready to step back.

Ownership shifts can also include bringing in a holding company or partner to own part of the business or an employee stock ownership plan (ESOP) if you want employees to gradually take over. The key is that you’re proactively changing “who owns what” in a way that supports your retirement and estate plans.

Let’s look at another example: A successful technology services company generating $8M in annual revenue is owned by its founder, Mark. He wants to transition leadership to his daughter Kate, who’s been COO for five years while ensuring his younger son James (who works in a different industry) also benefits fairly from the family business. Here’s how a strategic ownership shift might work:

This sets the stage for a 10-year transition plan that protects both business continuity and family harmony.

• Kate receives performance-based options for 15% of Class B shares

• Trust benefits both children equally

• Additional 20% of Class B shares transferred to trust

• Begin transitioning key client relationships

• Mark transitions Class A shares to Kate's control

• James receives equivalent value through other family assets

• Maintains clear operational control during transition

• Creates equitable wealth distribution between siblings

• Incentivizes business performance during transition

• Minimizes immediate tax impact through gradual transfer

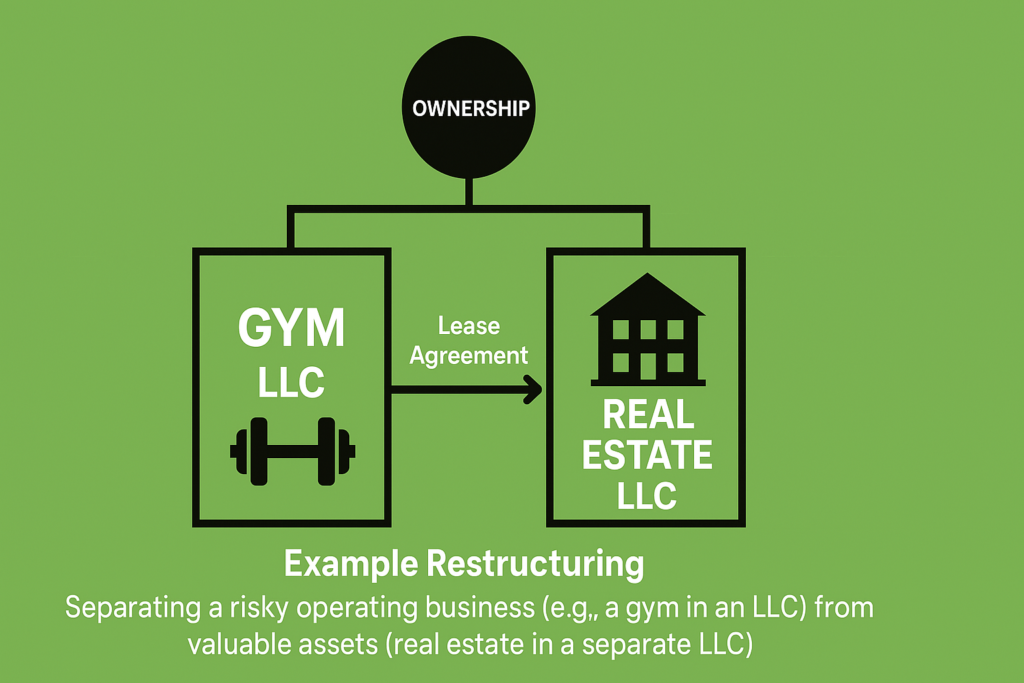

Holding Company Structures

This is a classic approach for both efficiency and asset protection4. You create a holding company (often an LLC or corporation) that owns your operating business (and any other subsidiaries or assets). The holding company doesn’t run day-to-day operations; it simply holds ownership stakes.

Holding companies can shield different lines of business or assets from each other’s liabilities. For example, you might have your main operating company (such as a gym) and a separate real estate LLC for the property it uses, all under one holding umbrella. Profits can be moved up to the holding company and redeployed into new investments or kept for future use, possibly at a lower tax cost than if you took them out personally. It also centralizes control – you, as the owner, mainly own the holding company, and the holding company owns everything else.

Let’s look at how this works in practice. Consider a successful manufacturing business owner who’s built several complementary operations over 25 years. Instead of running everything through one company and exposing all assets to shared risks, the owner restructures using a holding company – creating what we call a “corporate umbrella.”

Think of it as building financial firewalls. Each operation runs independently under the protection of its own entity, but you maintain streamlined control through the holding company. This approach particularly shines when planning for retirement or generational transfer – you can gradually shift ownership of the holding company while the day-to-day businesses continue operating smoothly.

Plus, such a structure might offer greater flexibility. Say you want to retire but keep generating passive income – you could sell the manufacturing operation while retaining the real estate that houses it, creating a steady rental income stream.

The Potential Downsides of Restructuring

Just because you can doesn’t mean you should. Before restructuring, you should be aware of the potential downsides it could entail.

In Conclusion

When Henry Ford II restructured his family’s company in 1956, he built a framework that would protect and grow his family’s wealth for generations. Today, that kind of forward-thinking is just as crucial for businesses of any size.

The signs that your business structure needs attention aren’t often clear: Maybe you’re paying more in self-employment taxes than necessary. Perhaps you’re not noticing friction between family members about future control. Or maybe you’re running multiple business lines through a single entity, exposing all your assets to shared risks. These inefficiencies could be drags on your company’s performance and even potential threats to your family’s wealth.

Restructuring isn’t easy, of course. It requires careful coordination between attorneys, accountants, and financial advisors. While we don’t practice law or give tax advice, we do help business owners understand how their corporate structure impacts their broader financial goals. More importantly, we can help you ask the right questions before you engage other professionals, potentially saving you time and money.

If you’re wondering whether your current business structure is working against your long-term financial plans, let’s talk. You can schedule a consultation by clicking the button below, and we’ll explore whether your business structure is truly optimized for both growth today and wealth preservation tomorrow.

Sources: