Donating to charity can be just as rewarding for your financial plan as it is for your sense of purpose. But like any financial decision, some approaches are savvier than others. So why not give in a way that maximizes your impact, especially when the IRS offers a more efficient path?

If you hold highly appreciated assets, such as public stocks, a private business, or investment real estate, you can amplify your charitable giving and reduce your tax bill by donating those assets directly instead of selling them first. Yet surprisingly, a Fidelity Charitable study found that while 80% of donors owned appreciated assets, only 21% had ever given them in-kind¹. Many may simply not have known how much more effective their giving could have been.

In this article, we’ll explain why donating appreciated assets is so tax-efficient and how to do it using three primary giving vehicles: direct charitable gifts, donor-advised funds (DAFs), and private foundations.

We’ll also highlight key tax advantages (like avoiding capital gains and claiming fair market value deductions), important IRS limitations, and recent changes, including the new One Big Beautiful Bill Act (OBBBA) that impacts estate planning.

As always, before acting on any giving strategy, be sure to coordinate with a qualified CPA or tax professional to ensure it aligns with your overall financial plan.

Why Donate Appreciated Assets?

Donating long-term appreciated assets directly to charity lets you bypass capital gains tax while deducting the asset’s full fair market value on your income taxes. Say you have stock worth $100,000 that you bought for $20,000 years ago. If you sold it, you’d incur capital gains tax on the $80,000 gain (at up to 20% federal, plus any state taxes). By donating the stock in-kind to a qualified charity instead, no one pays the capital gains tax. Not you, and not the charity (charities are tax-exempt).

The charity can sell the stock tax-free and use the full $100,000 for its mission. Meanwhile, you get to claim a charitable deduction for the stock’s full $100,000 fair market value, so long as you’ve held it for over one year (making it a long-term capital gain asset).

This double benefit, avoiding tax on the gain while deducting the full value, is a cornerstone of tax-efficient philanthropy.

By contrast, if you donated cash after selling the asset, your deduction would still be $100,000, but you’d have paid that capital gains tax out of the sale proceeds, leaving much less for you or the charity, while also affecting your greater tax strategy. Donating appreciated assets effectively lets you give “pre-tax” dollars, increasing your impact without increasing your out-of-pocket cost. It also helps rebalance your portfolio or diversify a concentrated position without tax pain.

Sell & Donate Cash vs. Donate Appreciated Asset

Sell & Donate Cash

Only about 80% of the asset’s value reaches the charity after taxes.

Donate Appreciated Asset Directly

The full 100% of the asset’s value supports the charity.

For example, one might donate shares of an overgrown stock position and then repurchase new shares with cash, effectively resetting their cost basis higher, which reduces future taxable gains. In short, if you’re sitting on highly appreciated securities or property and you’re charitably inclined, it’s often a win-win to contribute those assets directly instead of cash.

The IRS does impose annual Adjusted Gross Income (AGI) limits on charitable deductions, with an exception for donations to private foundations, as you’ll see below.. For donations of long-term appreciated assets to a public charity, your deduction is generally limited to 30% of your AGI per year. (By contrast, cash gifts to public charities are deductible up to 60% of AGI under current law.) If your gift exceeds that cap, the excess carries forward up to five years.

Let’s say your Adjusted Gross Income (AGI) this year is $500,000.

- If you donate cash to a public charity, you can deduct up to 60% of your AGI, or $300,000 in that year.

- If instead you donate long-term appreciated stock, your deduction is capped at 30% of AGI, or $150,000 in that year.

If your stock gift were worth $200,000, you could deduct $150,000 this year and carry forward the remaining $50,000 deduction for up to five future tax years until it’s fully used.

To get a fair market value deduction, the asset must be long-term (held >1 year). Short-term assets (held ≤1 year) are generally deducted at cost basis. And for any non-cash donation over $5,000, the IRS requires a qualified appraisal and Form 8283, so plan for a bit of paperwork. Now, let’s explore the main avenues for making these gifts.

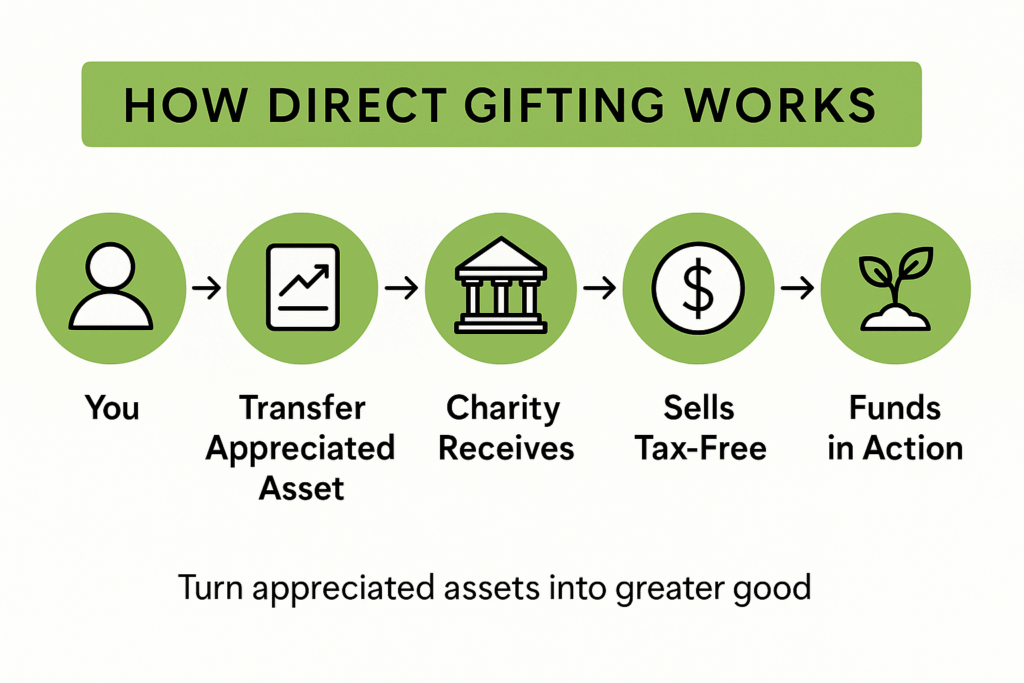

Option 1: Direct Gifts of Appreciated Assets to Charity

The most straightforward approach is to give appreciated assets directly to a public charity. “Public charity” includes most 501(c)(3) nonprofits, such as universities, hospitals, and churches. This approach is simple. For example, you transfer shares of stock or a piece of real estate directly to the charity, which sells it and keeps the proceeds.

As discussed, you can deduct the asset’s fair market value and you owe no capital gains tax on the appreciation. However, the charity may need to be equipped to accept the asset (check if they have brokerage accounts to accept stock).

Direct gifting works well when you know exactly which charities you want to support and are ready to give them the assets now. For example, if you want to endow a fund at your alma mater or make a sizable gift to your family’s foundation at a hospital, donating stock or property outright accomplishes that in one step. You get the deduction now, and the charity puts the funds to work immediately. The main trade-off is control: once the gift is made, you generally cannot redirect those funds. If you desire more flexibility in timing or choosing charities, a DAF (next section) might be worth considering.

Option 2: Donor-Advised Funds (DAFs)

A Donor-Advised Fund is often described as a “charitable investment account” or a middle-ground between direct giving and a private foundation. You contribute assets to a DAF typically hosted by a public charity sponsor (like Fidelity Charitable, Schwab Charitable, community foundations, etc.), and you immediately get the full tax deduction, but you can then advise grants to actual charities over time at your own pace. The DAF can sell donated assets tax-free and the proceeds can be invested, allowing potential growth for future charitable grants.

Contributions to a DAF receive the same tax treatment as gifts to any public charity. That means no capital gains tax on appreciated assets contributed, and a full market value deduction up to the same AGI limits (60% for cash; 30% for appreciated assets).

How a Donor-Advised Fund Works

1. Contribute Assets

Donate appreciated assets—like stock, real estate, or cryptocurrency—to a DAF sponsored by a public charity.

2. Receive Tax Deduction

Get an immediate charitable deduction for the full fair-market value (up to 30% of AGI for appreciated assets).

3. DAF Sells Tax-Free

The fund sells assets tax-free and can invest proceeds for potential growth.

4. Recommend Grants

You and your family recommend grants to qualified charities over time and at your own pace.

You can donate publicly traded securities, restricted stock, certain privately-held business interests, cryptocurrency, real estate, etc., depending on the DAF sponsor’s capabilities. For long-term appreciated assets, you get a fair market value deduction (with the required appraisal for non-public assets) just as you would donating to any public charity.

DAFs can be great for families who want to bunch or “front-load” donations in high-income years for tax purposes, while distributing to charities gradually. For example, a client selling a business might contribute a chunk of the equity or post-sale cash to a DAF in the year of the sale – generating a large deduction to offset income – then have the DAF grant out to various charities over the ensuing decades, as the family decides on causes.

Option 3: Private Foundations

For families seeking maximum control, flexibility in grantmaking (including to individuals or international causes), and perhaps to build a philanthropic legacy involving future generations, a private foundation is often the vehicle of choice. A private foundation is a self-funded charitable entity, usually a nonprofit corporation or trust, that you establish and control. The classic image is the family foundation with your name on it (e.g. the Smith Family Foundation), where you or your appointed board decide what charities or projects to fund.

Contributions to your private foundation are tax-deductible, but the IRS sets stricter limits because a private foundation is not a public charity. Cash contributions to a private foundation are deductible up to 30% of AGI, and donations of long-term appreciated assets are deductible up to 20% of AGI².

Additionally, and this is crucial, if you donate non-publicly traded assets (like private stock or real estate) to a non-operating private foundation, your deduction is limited to the asset’s cost basis (original value), not the full market value³. Only publicly traded securities can be deducted at fair market value to a foundation (still subject to the 20% AGI cap).

In other words, donating highly appreciated public stock to your foundation can still avoid the capital gain and give you a full market value deduction (up to 20% of AGI), but donating, say, appreciated real estate or a stake in your LLC to your foundation would generally only allow you to deduct what you paid for it, sharply reducing the tax benefit.

Rules & Limitations

- Annual Filing: Must file Form 990-PF disclosing assets, grants, and expenses.

- Excise Tax: 1.39% tax on net investment income each year.

- Distribution Requirement: At least 5% of investment assets must go to charitable purposes annually.

- Setup Costs: Legal fees to establish and obtain 501(c)(3) status.

- Ongoing Administration: Requires accounting, legal help, and possibly staff for large foundations.

Why even go through all this if there are so many more obstacles and limitations? Because a private foundation offers unmatched control and legacy-building. You (and perhaps your children or other trustees) control the investments and grantmaking. You can even pay reasonable salaries to family members who serve as directors or staff, which can be a way to involve your heirs in philanthropy.

But for purely tax-efficient giving, it’s usually less optimal than a DAF or direct gifts due to the tighter deduction limits and added costs.

Comparing the Giving Vehicles

| Feature | Direct Gift to Public Charity (Appreciated Asset) |

Donor-Advised Fund (Public Charity Sponsor) |

Private Foundation (Non-Operating) |

|---|---|---|---|

| Immediate donor tax deduction | Yes – Fair Market Value of asset (if held >1 year) | Yes – Fair Market Value (asset >1 year) | Yes – FMV if public stock; otherwise cost basis for non-public assets |

| AGI Deduction Limit (Cash) | 60% of AGI | 60% of AGI | 30% of AGI |

| AGI Deduction Limit (Appreciated Assets) | 30% of AGI | 30% of AGI | 20% of AGI |

| Capital Gains Tax on donated assets | None (charity is tax-exempt) | None (DAF sponsor is tax-exempt) | None (foundation is tax-exempt) |

| Annual Distribution Requirement | N/A (gift is spent by charity) | None – no payout required by law | ~5% of assets must be granted yearly |

| Control over assets & grants | Donor has no control after gift | Donor advises grants (sponsor controls ultimate decisions) | Donor/family has full control (within IRS rules) |

| Privacy of giving | Can be public or anonymous (per donor’s arrangement with charity) | Can be anonymous to end charities | Must file public tax return (grants and key financials disclosed) |

| Administrative burden | Very low (charity handles everything) | Low (DAF sponsor handles investing, filings) | High (setup entity, annual filings, compliance needed) |

| Costs | None to donor (maybe transaction fees only) | Low–Moderate (admin fee ~0.6–1%, investment fees) | High (legal setup costs; annual tax prep; 1.39% excise tax) |

As you can see, direct gifts and DAFs enjoy the more generous tax deduction limits, while private foundations give up some upfront tax benefit in exchange for greater control. All three approaches let you avoid capital gains taxes on donated assets, which is often the biggest tax win. In fact, the right choice for your family may be a combination of tools. For example, using a DAF for convenience and privacy and a foundation to involve family in grantmaking, all while still making the occasional direct gift to charities for immediate impact.

Estate and Gift Tax Exemptions Post-OBBBA

A major recent development is the passage of the One Big Beautiful Bill Act (OBBBA), signed into law in 2025. Among many tax changes, OBBBA made the federal estate and gift tax exemption “permanent” at $15 million per individual (indexed for inflation) starting in 2026 or $30 million for a married couple, up from an already high $13.99 million each in 2025⁴.

This stability is great news as it removes the urgency many felt to make large gifts or other moves before 2026 to use the diminishing exemption. However, “permanent” in tax law often just means ‘for the time being’ as future Congresses can still change it. So wealthy families shouldn’t become complacent. If your estate significantly exceeds or risks exceeding $15 million (or $30M as a couple), you are still (potentially) exposed to estate tax and should continue proactive planning.

Even for families well under the exemption, charitable giving can shape the legacy you leave and engage the next generation in purposeful wealth stewardship. With OBBBA keeping exemptions high, fewer families will owe federal estate tax, but that simply means charitable giving is driven more by values and income tax strategy than by estate tax minimization.

We encourage you to review your estate documents in light of the new law as many older wills and trust formulas were written for a much lower exemption and could overfund certain trusts or cause unintended outcomes under a $15M exemption scenario.

In Conclusion

Tax-efficient philanthropy is a wonderful thing: you get to support meaningful causes, your family potentially reduces tax liabilities, and ultimately more money goes to work where you want it. As always, the best approach for you will depend on your unique mix of assets, income, and goals. It’s always wise to involve your financial advisor and tax professional when executing these strategies to ensure compliance (for example, obtaining proper appraisals and documentation for non-cash gifts) and to optimize the timing and amount of donations for your situation.

Our philosophy is that a wealth plan should reflect both financial objectives and personal values. Philanthropy is where those often meet. If you haven’t revisited your plan lately, now is a great time. Let’s make sure your retirement plan, succession plan, and philanthropic efforts are all working in concert to help secure your family’s future and make a lasting impact. Feel free to reach out to set up a review so we can help you maximize your wealth’s potential for good.

Sources: