If you recall our previous article about the kinds of stock options available, Non-Qualified Stock Options are issued to employees or stakeholders of a company, such as subcontractors, vendors or partners. They give any holders (grantees) of the options the right but not the obligation to purchase company shares at a set price, known as the grant price, strike price or exercise price. The price at exercise is the current Fair Market Value of the underlying asset, and it may be the same as the grant price or higher.

Tax Advantages

Non-Qualified Stock Options are less tax-advantaged than Incentive Stock Options (ISOs). Unlike ISOs that allow you to avoid paying any tax on the bargain element if exercised correctly, Non-Qualified Stock Options allow for no such avoidance. However, there are methods to lower the tax obligation on NQSOs, which we will go into below.

Taxable Events

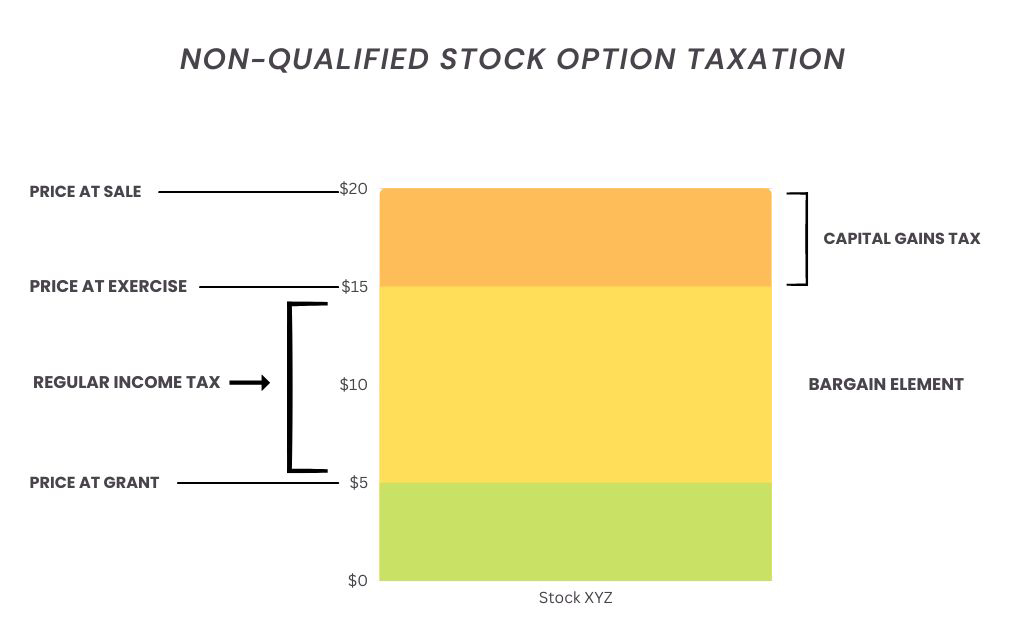

There are two taxable events applied to Non-Qualified Stock Options. How the IRS taxes them depends on the amount of time you hold the shares upon exercising your options. However, getting granted Non-Qualified Stock Options is not a taxable event in and of itself because they’re not treated as a form of income until you exercise them.

Tax on the Bargain Element

For example, you receive 100 shares of XYZ options with a strike price of $5. The stock price rises to $15 a share, and you decide to exercise. You then pay income tax on that $10 spread for each option you exercised. In this particular case, you’ll be paying income tax on the $1,000 bargain element.

Tax on the Sale of the Shares

The next taxable event transpires when you sell the shares you physically obtained upon exercising your options. The earnings that are taxed is calculated as the share price at the moment of sale minus the share price at exercise multiplied by the number of options exercised. The rate at which the IRS will tax them depends on how long you hold the shares after exercising. If you have held them for less than a year, they will be subject to short-term capital gains tax. If you hold them for more than a year, you will get to pay the lower long-term capital gains tax.

Feb 01, 2023

Grant Date

Grant Price of $5

Feb 01, 2024

Exercise Date

Stock price of $15. Income Tax is paid on the $10 difference.

Aug 01, 2024

Sell Date < 1 Year

Short-Term Capital Gains Tax is paid on the current Fair Market Value of $20 minus the $15 stock price at exercise.

Feb 02, 2025

Sell Date > 1 Year

Long-Term Capital Gains Tax is paid on the current Fair Market Value of $20 minus the $15 stock price at exercise.

(Click on arrows to scroll through)

Holding out for a lower tax rate depends on your risk tolerance, as the stock price can dip back below the exercise price or even the strike price. You may also find it challenging to obtain enough capital to exercise your options and enter into a hold position. If you have 1000 options that allow you to buy a stock for $40, you’ll need $40,000 to purchase the stocks. Risking $40,000 for a lower tax rate is probably beyond most people’s appetite for risk.

Ways to Exercise Your Stock Options

Fortunately, there are a few ways to exercise your options that will help reduce risk and minimize taxes with the right combination.

Sell-to-Cover Exercise Strategy

If you’d like at least to have some amount of stocks in your portfolio to get the lower tax rate, you can execute what’s known as a “sell-to-cover” strategy. In this case, you exercise and sell a set amount of options and shares that will cover the exercise and purchase another set of options and shares. The bargain element will be taxed, and then you will pay long-term capital gains tax on the shares received from the sale of the

It works as follows. You have 1,000 options of XYZ stock with a $100 exercise price and a current Fair Market Value of $120. You want to buy ten shares for $1,000. You need to exercise 50 options and immediately sell them for a profit of $20 each, which gives you the $1,000 to exercise another ten options and hold the resulting shares, minus the federal income tax on that $1,000. After a year, if the stock price is still above the exercise price, you can sell those ten shares at the preferred long-term Capital Tax Rate.

Cashless Exercise

If you’d rather not worry about tax rates and prefer to lock in profits, you can exercise options and sell shares simultaneously with a cashless exercise strategy. Your only profit will be the bargain element, which is taxed as regular income, as noted above.

Always pay attention to what your asset allocation will look like if you decide to not sell your shares right away. Oftentimes, holding a large position in one stock goes against the principles of diversification. Some factors that may influence your decision to hold or sell include your age and time from retirement, dividends, and the belief that the company will continue being successful.

What is the best strategy for you and your risk tolerance? Going over your employee stock option plan with a financial advisor will help you decide whether you should accept stock options as compensation or, if you already possess options, determine the best exercise strategies in line with your portfolio, risk tolerance, and tax situation.