There is a straightforward strategy that can help diversify your portfolio, reduce volatility risk, and utilize the concept of compound interest to maximize your gains. It’s called dividend investing, or the dividend snowball effect, and there may be a place for it in your portfolio. Let’s take a closer look.

What is Dividend Investing?

Dividend investing is an investment strategy that involves purchasing dividend-issuing stocks, ETFs, or mutual funds and buying more dividend-paying assets upon receiving those dividends. You can either purchase different dividend stocks or the same stocks that issued the dividends through a DRIP program with zero fees or commissions.

Example: You purchase 100 shares of Stock ABC for $10,000. It has an annual dividend yield of 4, meaning you will get $400 in dividends. You can either acquire four more shares of Stock ABC (assuming the share price remains $100) or obtain stocks of different companies.

The rationale is that, eventually, the dividends you continually receive will ultimately reach such heights that you will have purchased a large chunk of your portfolio using dividends rather than personal investment funds.

If you put this process into effect for long enough, the impact of compound interest comes into play, causing your portfolio to grow by orders of magnitude.

Unfortunately, it’s not as simple as just snapping up every stock you come across, as not every equity pays out dividends, and many that do may not be worth investing in. Here are a few factors to consider when choosing a dividend-paying stock.

Key Elements of Dividend Stocks

Dividend Yield

You can determine a stock’s dividend yield as a percentage by dividing the share price by its annualized dividend. A high yield does not necessarily qualify it as a quality pick. A higher-than-normal dividend yield may even be a red flag, as the yield percentage will naturally rise if the stock price drops, and a falling price may mean the company is in dire financial shape.

What may be more important is not a high dividend yield but a dividend that consistently increases over time. For example, Coca-Cola’s dividend has steadily risen for over 30 years¹ and is among the top 45 “Dividend Kings.” It currently has a dividend yield of 3.19%. At the same time, we can see that Vornado Realty Trust has a dividend yield of 10.05% and nearly all-time stock lows. With its lower dividend yield, Coca-Cola is probably the safer choice because it has proven its ability to improve its financial position for many years.

Payout Ratio

To help us determine if a dividend yield is sustainable, we can utilize a stock’s payout ratio. The payout ratio is the dividend payout as a proportion of the company’s overall earnings. If a share is worth one dollar and the dividend is 50 cents, the payout ratio is 50%.

There is no generally accepted optimal payout ratio, but if a company has a payout ratio of over 100%, it means they are paying out more than they are taking in. Therefore, their dividend yield is not sustainable.

When it comes to dividend yields, the above two are probably the most important to calculate when attempting to determine if a stock has a good place in your dividends portfolio. But just because a company has a high dividend yield and an excellent payout ratio, we wouldn’t recommend pouring a significant portion of your assets into just one stock. We always stress the importance of portfolio diversification over stock picking.

Dividend Investing Benefits

Now, we can determine if an asset fits into a dividend investing strategy. Besides the compounding effects of dividend investing, let’s look at other ways dividend investing benefits you and your portfolio.

Reduces Volatility

A company that chooses to issue dividends sees more stable stock prices and less volatility.² They are proving to investors that they are operating with a profit and decent cash flow and can give up some of their income rather than reinvest it into the company to continue operating. The company also knows that if they cut their dividend, they may lose investor confidence – they will go to great lengths to prevent that from happening.

Hedges against Inflation

There is probably no greater obstacle to your portfolio’s success than inflation. An average 3% inflation rate would double your cost of living in only 25 years. If a string of poor market years hits your retirement account and you haven’t prepared for it, you could find yourself in trouble. Any retirement plan should consider inflation’s effects on purchasing power and minimize them as much as possible. Dividend stocks can help that fight.

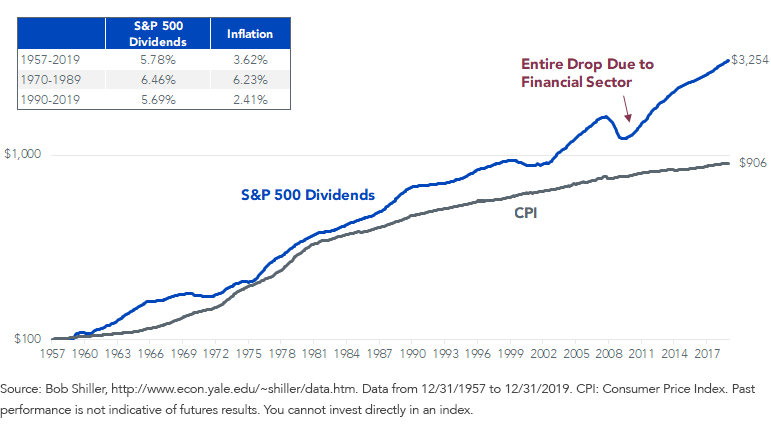

Since 1957, America has witnessed an annualized inflation rate of 3.69%.³ At the same time, S&P 500 dividends have grown an average of 5.8%, a little more than two percent higher than inflation.⁴

Inflation Fighters

The above chart shows that S&P 500 dividends have consistently outpaced the Consumer Price Index.

Dividend Growers

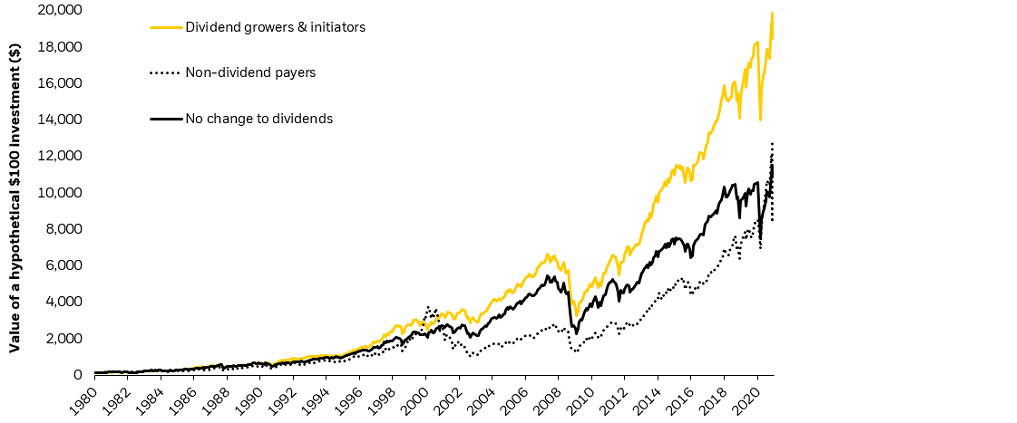

Blackrock, the world’s largest asset manager, researched portfolios that consisted of either stock with growing dividends, non-growing dividends, or stock that didn’t pay dividends at all. The holdings with growing dividends outperformed non-dividend payers and dividend payers whose dividends didn’t continuously grow.

These two charts show that dividend-paying assets outperform inflation and their non-dividend-paying counterparts. The evidence strongly points to dividend investing as a strong ally in the struggle against inflation.

Lower Tax Rates

The salary you receive from work is probably taxed a the standard income rate. And when you pay taxes on money earned through dividends, you pay capital gains taxes, which are considerably lower. They’re so much lower that Warren Buffet famously pays his taxes at a lower rate than his secretary because most of his income comes from dividends and capital gains rather than payroll income.

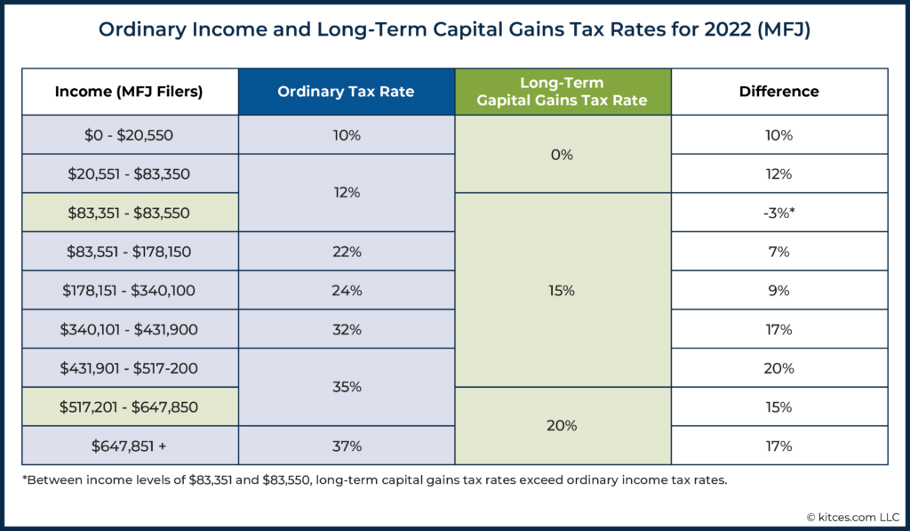

Tax Rates

As you can see from the table above, regular income can be taxed as high as 37%, while the government will tax your dividends at a maximum 20% rate.

If you earn dividends through a tax-advantaged retirement account such as an IRA or 401(K), taxation won’t begin until you start taking distributions in retirement. Unfortunately, Uncle Sam taxes those dividends as regular income once you retire. However, any dividends you receive in a Roth account won’t be taxed – this allows the compounding effects to occur unfettered.

In Summary

In this article we’ve learned how the compounding effects of dividend reinvesting can grow a portfolio faster than non-dividend-paying assets. The key identifiers of a strong dividend stock are its yield and payout ratio – we want a high but sustainable yield. The longer a company can pay out a strong dividend and manage to grow it simultaneously, the more likely it is to be a strong contender for a spot in a portfolio.

We also learned that a dividend-investing strategy reduces exposure to volatility and inflation while maintaining lower tax rates. While a dividend investing strategy isn’t a perfect solution, it makes a portfolio resilient and friendly to quicker growth in many cases.

Will a dividend-investing strategy improve your retirement portfolio and help you achieve your investing goals? Find out by clicking the button below.

Further Reading