Longevity is a double-edged sword. On one side, the gift of a longer life brings more experiences, memories, and milestones. On the other, it introduces complexities into how one financially prepares for their later years.

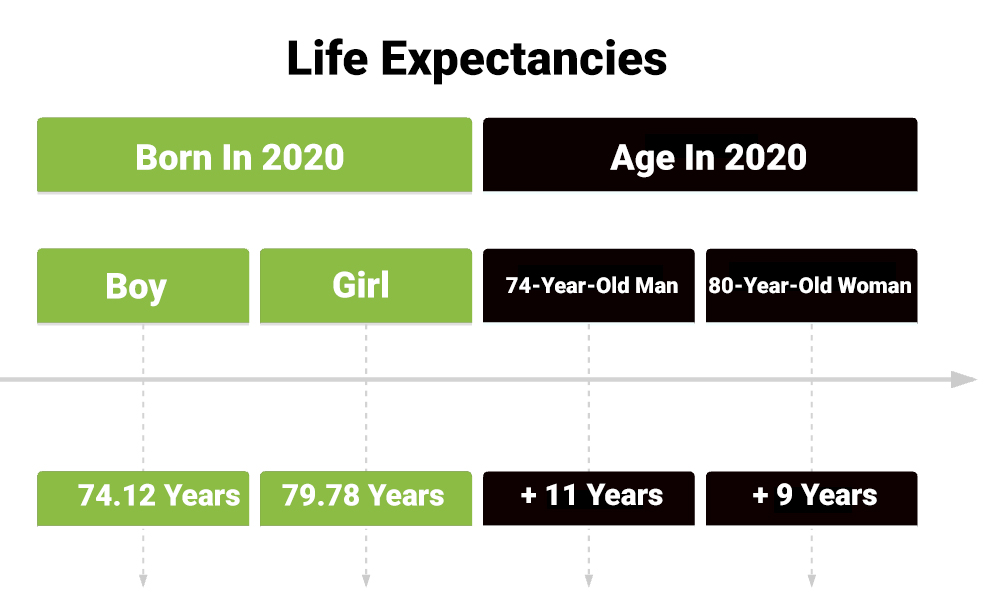

The complexities begin with trying to figure out just how long you will live. Using the Social Security Administration’s Life Expectancy Tables¹, we see that, on average, a boy born in 2020 has a life expectancy of 74.12, and a girl has an expectancy of 79.78 years.

However, a 74-year-old man in 2020 could expect to live another 11 years, and an 80-year-old woman could expect to live nearly another ten years! This doesn’t mean someone born in 1946 was initially expected to live 85-90 years. Instead, it highlights the evolving nature of life expectancy predictions.

This phenomenon is known as conditional life expectancy, and it has profound implications for retirement planning. In fact, it is likely the most challenging variable to factor in when preparing for retirement and determining aspects such as withdrawal strategies, retirement costs, and estate planning.

Understanding Conditional Life Expectancy

Usually, life expectancy is a prediction made at birth, providing an average lifespan one can expect based on current mortality rates. On the other hand, conditional life expectancy adjusts these predictions as we age, accounting for the fact that older individuals have already sidestepped numerous potential mortality risks, such as early-life diseases, accidents, or other life-threatening events. Additionally, healthy lifestyles, access to healthcare, and advances in medical treatments can extend life expectancies for older populations.

Considering technology is advancing at ever-increasing rates, it’s becoming increasingly difficult to figure out just how long we need our money to last – in fact, it’s difficult to even pin down a ballpark figure.

Implications for Financial Planning

As conditional life expectancy shifts our understanding of longevity, we need to adjust our financial plans in tandem.

Asset Allocation and Investment Strategy

A popular asset allocation strategy is the Rule of 100, which suggests that individuals should subtract their age from 100 to determine the percentage of their retirement portfolio to invest in riskier, high-growth assets like stocks. However, given the extended life expectancies, this rule might be too conservative for some individuals.

For example, a 64-year-old in 2020 may have had 36% of their savings in growth investments, which Schwab labels a moderately conservative allocation with a moderately short-term timeframe.²

But if you are going to live to 94, should you actually have a large sum of your savings in a moderately conservative allocation at the age of 64? The growth associated with a conservative portfolio may not keep up with inflation over thirty years, resulting in you running out of money in your lifetime – one of the greatest forms of anxiety American retirees face.³

Navigating Social Security Decisions

Social Security is another key consideration when discussing retirement and longevity. The timing of when to start taking your Social Security distributions has profound implications on retirement savings. You could opt to begin as early as age 62, wait until age 70, or choose any point in between. The Social Security Administration’s actuary tables are designed with a one-size-fits-all approach, assuming a uniform life expectancy for everyone.

However, real-life is more nuanced. Factors like your family history, lifestyle, age, and current asset situation play a role in determining the most strategic time to claim Social Security benefits. These considerations, combined with the uncertainty surrounding life expectancy, further emphasize the importance of careful financial planning.

Estate Planning

Longer life expectancies can also complicate the timing and process of transferring wealth to younger generations. Deciding when to start gifting assets is a big issue – transferring wealth too early might jeopardize your own financial security while waiting might miss beneficial tax planning opportunities or the chance to witness heirs benefit from the assets. Contributing to the pressures some may face now is the eventual expiration of the Tax Cut and Jobs Act, which will see tax exclusion limits drop.

Also, the longer you live will necessitate taking more and more withdrawals from your savings – savings you may have wanted to save for your heirs. New family members may also come into the picture, complicating your strategy and potentially watering down the impact of your wealth transfer.

On the other hand, you may have a better opportunity to see any philanthropic endeavors come to fruition, whether it’s through active participation or witnessing the benefits of your donations. On the legacy front, you will have additional years to consider how you want to be remembered and ensure your actions and financial plans align with those aspirations.

Healthcare Considerations

Of course, as we grow older, we not only have to worry about our dollar stretching long enough to make ends meet and maintain our desired lifestyle but also to pay off the mounting medical bills that may stack up.

Rising Costs

It’s no secret that healthcare expenses are rising rapidly. As you age, medical costs— from routine check-ups to specialized treatments—can take a considerable chunk of your retirement savings.

Fidelity’s Retiree Health Care Cost Estimate suggests that a single 65-year-old individual in 2023 might need approximately $157,500 saved (after tax) to cover healthcare costs in retirement. Similarly, a retired couple aged 65 in 2023 may require about $315,000 saved for healthcare expenses.⁴

Besides general health care costs, there’s a significant chance of needing long-term care. In fact, about 70% of today’s elderly will require some form of long-term care⁵ – and it’s not cheap. Currently, the median monthly cost nationally for nursing home care stands at an astounding $8,821 for a private room. Those currently in their golden retirement years might see monthly costs of $11,855 for a private room by 2030.⁶ Does your retirement plan take into account these kinds of costs? It’s an important question to ask yourself and take action before it’s too late.

In Conclusion

This is all a lot to take in – we don’t know how long we will live, whether we will need long-term care, how high our medical bills might be, or what direction the stock market will go when we retire. We may have to stay exposed for more extended periods of time to make up for longer life expectancies, but we need to keep short-term goals into account as well.

Consulting a financial advisor who’s up-to-date with the modern landscape is crucial. They can guide you in planning for both the exciting times during early retirement and the unforeseen years to follow that are more difficult to forecast. They’re also informed about how advancements in healthcare and technology might shift our expectations for savings and health expenses.

Ready to review your plan with a trusted fiduciary financial advisor to ensure it considers changing life expectancies and healthcare costs? Click below to schedule your consultation!