Several corporate scandals involving Employee Stock Options (ESOs) have driven companies to diversify their compensation packages with less risky Employee Stock Option Alternatives.

Enron’s Employee Stock Options Scandal saw executives driving up the stock price by manipulating projected profits and other devious methods to cash out their Incentive Stock Options at greater profits.¹ Years later, at WeWork, many employees were left feeling shortchanged after promises of riches left them with worthless stock options. ²

So what ESO Alternatives are available, and what are their advantages and disadvantages?

ESO Alternative #1: Restricted Stock Units (RSUs)

Restricted Stock Units are an excellent alternative to Employee Stock Options because you don’t need to put any of your own money at risk, and they nearly always hold value. There are no options nor an exercise price involved – the share value can never dip below an option’s exercise price, thus rendering it useless. The employer simply issues a specified number of shares on a vesting date or upon satisfying a performance threshold.

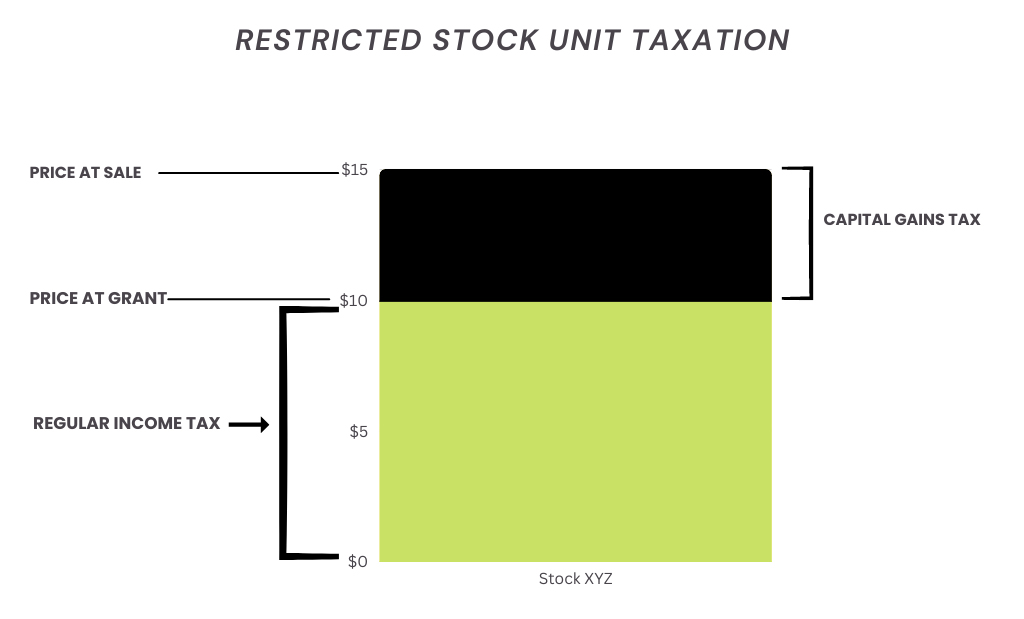

Grantees can sell the newly acquired shares right away or hold onto the shares and hope the price of the stock increases. Grantees owe regular Income tax on the Fair Market Value of the stock upon the vesting date; unlike some employee stock options, RSUs do not qualify for the sometimes beneficial 83(b) tax treatment. New stock owners of former RSUs owe capital gains tax on any profit earned as the difference between the sale price and the Fair Market Value at the time of vesting.

Restricted Stock Unit Example

Jeremy signs a contract for Company XYZ with a salary, benefits, and 5,000 RSUs with a five-year vesting period. Those RSUs are non-transferable and do not give Jeremy any voting rights. He can’t pay taxes on them early either, unlike with employee stock options.

- Year 1: Jeremy receives 1,000 shares valued at $10 each and sells them immediately. He owes regular income tax on $10,000.

- Year 2: Jeremy receives another 1,000s shares valued at $10. He holds until the stock price reaches $15 a share, sells, and pays capital gains tax on that five-dollar difference. If Jeremy has held the shares for less than a year, he owes short-term capital gains tax. If he owns the shares for longer than a year, he owes the significantly lower capital gains tax.

- Year 3: Jeremy receives another 1,000 shares at a $10 share price. He holds, and the stock sinks to $5 a share. He now has $5,000 in capital losses he can use to offset any other capital gains. If he hasn’t got any capital gains, he can deduct up to $3,000 from his regular income tax obligation. Jeremy can roll the remaining $2,000 capital loss into the following year’s deductions.

If Jeremy quits at the end of year three, he forfeits his remaining 2,000 RSUs.

ESO Alternative #2: Stock Appreciation Rights (SARs)

With Stock Appreciation Rights, you earn a profit on any increased value in the stock price within a specified period of time. The payment can (and usually does) come in the form of a cash bonus or (more rarely) in the form of an equivalent amount of shares.

Also, unlike Employee Stock Options, Stock Appreciation Rights do not pose a risk to personal funds. Still, they run the risk of losing 100% of their value, so one should be acutely aware of the risk they are taking upon deciding to receive SARs in place of a higher salary. The IRS taxes SARs the same way as non-qualified stock options, i.e., as regular income. Unlike RSUs, they are transferable. They are also subject to clawback provisions if certain conditions are violated, such as going to work for a competitor too soon after parting from the company.

Like ESOs, Stock Appreciation Rights are issued through a vesting schedule, either pegged to specific performance metric or to set dates, such as yearly issuances.

Stock Appreciation Rights tie worker performance to the company’s stock price, giving them a vested interest in the profitability and performance of the company. SARs incentivize workers better than RSUs because there needs to be constant growth to see a benefit. The theory goes that the more effective SAR grantees are, the more profitable the company will be, and thus the higher the stock price will go up, and the more the grantees will earn.

Hard work —> more company profit —> higher stock price —> more valuable SARs

Sometimes, SARs are issued alongside regular employee stock options to help pay for taxes or to assist in exercising the options if you aren’t utilizing a cashless exercise strategy. Like employee stock options, there is a vesting schedule and an expiration date. Employees can exercise their rights at any time in that window.

SARs are riskier than Restricted Stock Units because they could become worthless even without the company going bankrupt or shutting its doors. The company’s stock price may drop below the exercise price and stay there forever (or at least beyond the expiration date), leaving you scratching your head as to why you didn’t simply take a higher salary.

However, they are less risky than employee stock options because you can achieve the same kinds of profit while not being exposed to a potential greater than 100% loss. If you exercise your employee stock options and use cash to purchase the shares, and the stock price subsequently crashes, and the company goes bankrupt, you’ve lost your entire investment (plus taxes).

Stock Appreciation Rights Example

Maria starts working at Company XYZ, and in her contract, they stipulate that she will receive 500 SARs with a stock value of $10, which is the Fair Market Value at the time of signing the contract. The distribution schedule is 100 SARs each year for five years.

- Year 1: XYZ stock goes up to $15, so Maria exercises and receives a $500 bonus subject to regular income tax.

- Year 2: The stock price drops to $9 a share - Maria gets no additional compensation straight away, but she still has 100 vested Stock Appreciation Rights that she can exercise once the share price goes up.

- Year 3: XYZ stock explodes in value, reaching $30. She exercises Year Two and Year Three SARs simultaneously to get a $4,000 bonus.

Stay tuned for our next article, where we will delve into other Employee Stock Option Alternatives. If you are the current owner of ESOs or their alternatives, or are being offered them, don’t hesitate to reach out for a consultation to determine if they’re the best fit for your portfolio and risk capacity. Just click the button below!