In our last article on Employee Stock Option Alternatives, we went into Restricted Stock Units and Stock Appreciation Rights, both of which are excellent alternatives to the sometimes risky (and potentially costly!) Employee Stock Options. In this article, we go over Phantom Stock and Employee Stock Purchase Plans.

Phantom stock

Phantom stock provides the benefits of owning a company’s stock without actually owning the stock itself, similar to Stock Appreciation Rights. The value of the phantom stock is pegged to the actual stock and may even pay out the same dividends to those with vested phantom shares.

Phantom stock is usually issued to upper management and can be modified by the company at any time. All proceeds are taxed as regular income – even any hypothetical dividends, as opposed to the capital gains treatment usually afforded to dividend-paying stocks.

Appreciation-Only Phantom Stock Plan

There are two basic forms of phantom stock. The first form pays out only a stock’s appreciation from a starting point, similar to Stock Appreciation Rights. The primary difference is that owners of phantom stock cannot choose when to take their bonus as opposed to holders of SARs, who can usually cash out at any time once they’ve vested.

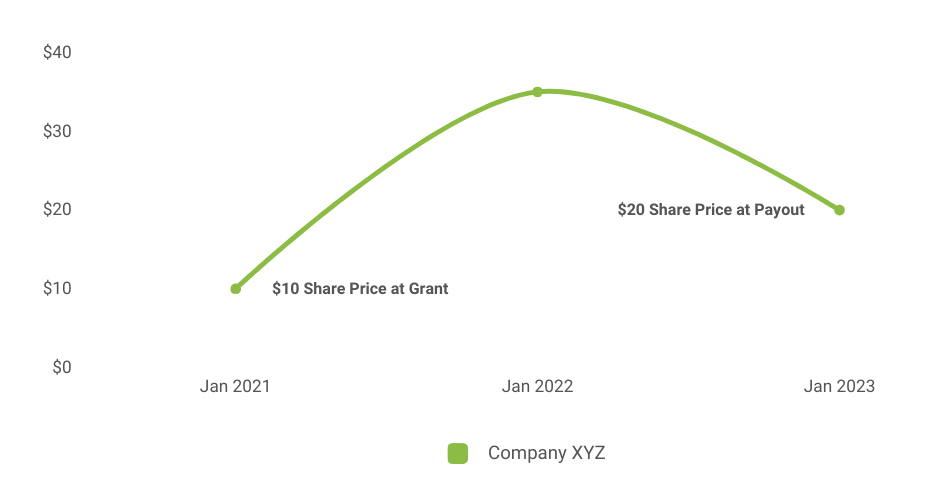

Appreciation-Only Phantom Stock Example

Mark, the CIO of Company XYZ, receives 1000 phantom shares of stock that vest in 2 years with an instant payout. The share price when the employee receives them is $10 a share. Eventually, the stock price goes above $30, but Mark’s shares haven’t vested yet. Unfortunately, the price starts dropping. On the day of the payout, the share price is $20. Mark receives 1000 shares multiplied by a ten-dollar difference in grant price and payout price.

1000 shares x $10 = $10,000 Bonus

Not bad. But, if the stock kept falling and dipped below $10 at the payout date, Mark wouldn’t have received anything but a bad mood.

Full-Value Phantom Stock

The second form sees phantom stock owners receiving the full value of the stock instead of just the appreciation value. This form of phantom stock compensation is naturally less risky because it doesn’t depend on stock growth to make a payout. The stock can continually drop in value, and the owner of the phantom stock will still see a payout as long as the underlying asset value has value. The only time the holder of full-value phantom stock won’t see a bonus is if either the company goes bankrupt or the company utilizes a clawback provision.

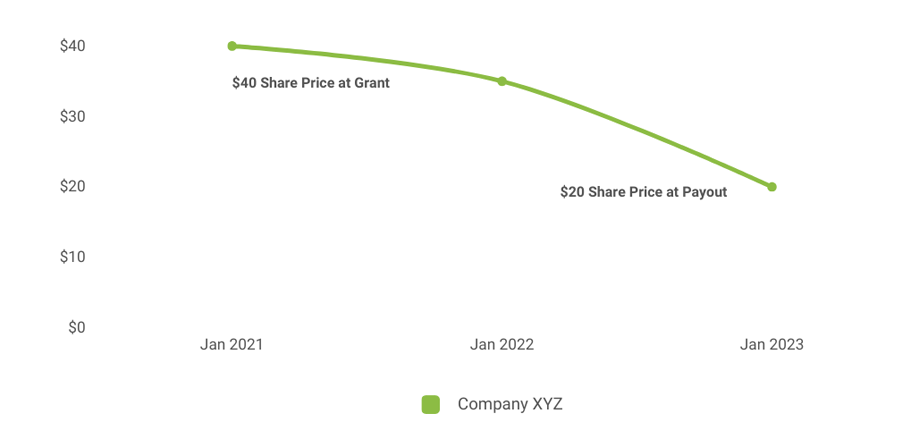

Full-Value Phantom Stock Example

Let’s imagine that Mark’s phantom shares are of the full-value variant. He receives 1000 phantom shares at $40 each. At the payout date, the price has slumped to $20. But even though they have lost half their value, Mark still gets a much bigger payout.

1000 shares x $20 = $20,000 Bonus

Even though the stock only lost value since receiving phantom shares, he still gets a good bonus! The verdict is in.

Full Value Phantom Stock plans > Appreciation-Only Phantom Stock Plans.

Employee Stock Purchase Plans (ESPPs)

Finally, rounding out the alternatives to employee stock options, we have Employee Stock Purchase Plans. These programs allow employees to purchase company stock at a discounted price, usually between 5% – 15%.¹ When you opt-in, you proclaim the amount of post-tax funds you want to be deducted from each paycheck for the eventual stock purchase. After an accumulation period, also known as the ‘offering period’, company stock is purchased on your behalf. Once you purchase shares, they’re yours forever. You can quit the company and continue to take advantage of any rights being the shareholder might bestow upon you.

Grant Date

Offering Period

Money is deducted from your post-tax paycheck

Purchase Period

There may be several share purchases in a purchase period

Purchase Date

The final date shares are purchased

Sell Date

The date you sell your shares

The Lookback Provision

Some Employee Stock Purchase Plans provide a loopback feature that allows you to purchase shares at the Fair Market Value on the grant date rather than the Fair Market Value on the purchase date, providing an extra boon to your compensation.

Like employee stock options, ESPPs are risky because they involve actually purchasing stock. Upon purchasing company shares, there is the chance that they suddenly drop in value, leaving you with a substantial loss.

One potential scenario is the one in the graph above. The employee purchases a set of shares, just for the stock price to drop down. The purchaser has lost their chance at ‘arbitrage’ by not selling immediately, and the stock price may never go up.

So, should you hold or should you sell straight away? That depends on your risk tolerance and ultimate financial goals. Oftentimes, investors and savers don’t want a single stock to take up a significant portion of their portfolio. Other times, an employee may not mind owning so much of a particular stock, especially if it pays dividends and they believe in the long-term financial outlook of their company.

ESOs and their alternatives are frequently more complex than initially thought, especially when it comes to looking at your overall financial picture and lifelong tax obligation. They may also pose unique risks that traditional remuneration packages simply don’t. If you’d like a consultation on your Employee Stock Option compensation plan, don’t hesitate to schedule a meeting.

Further Reading